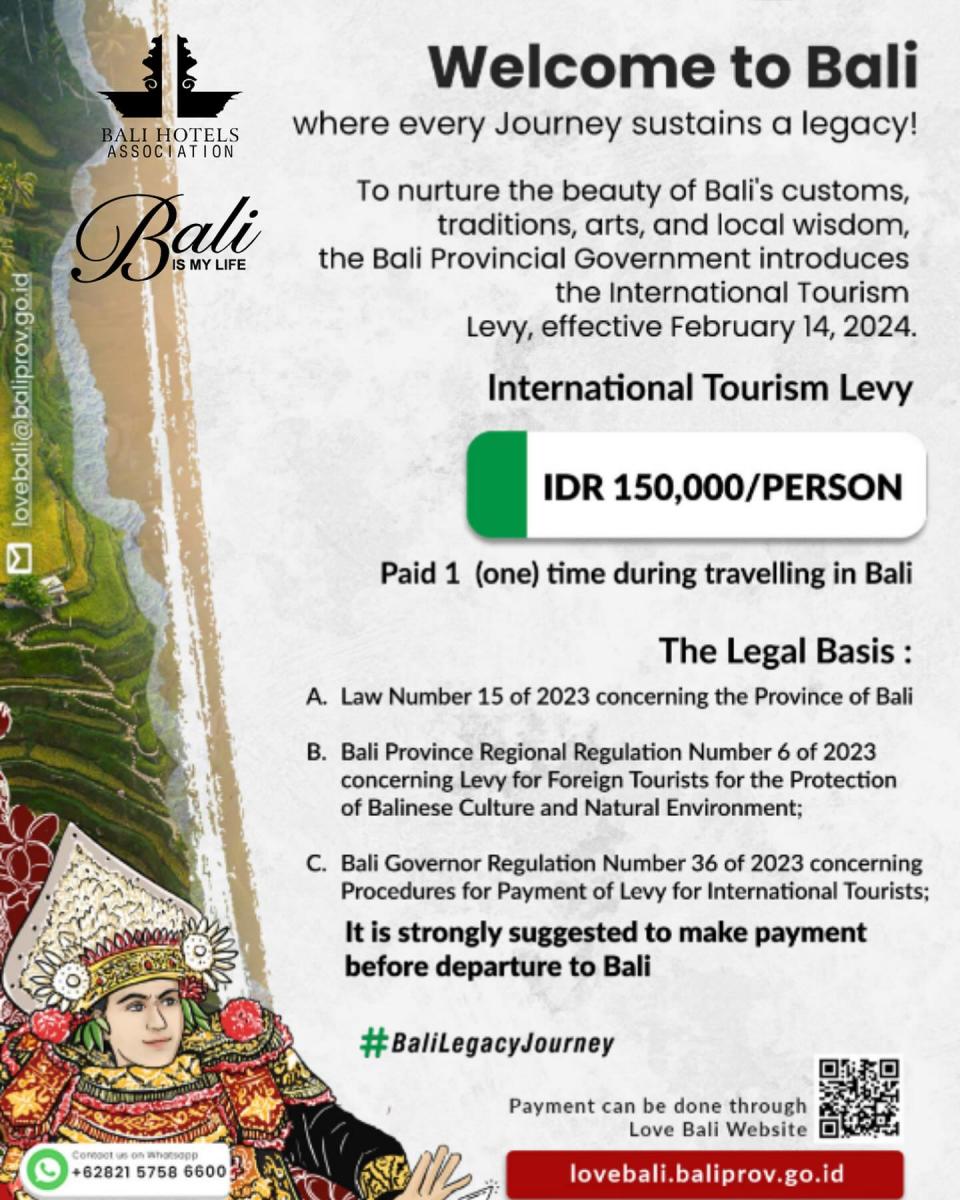

This initiative is designed to contribute to the preservation and continuation of the island's unique cultural heritage while reinforcing its dedication to sustainable tourism.

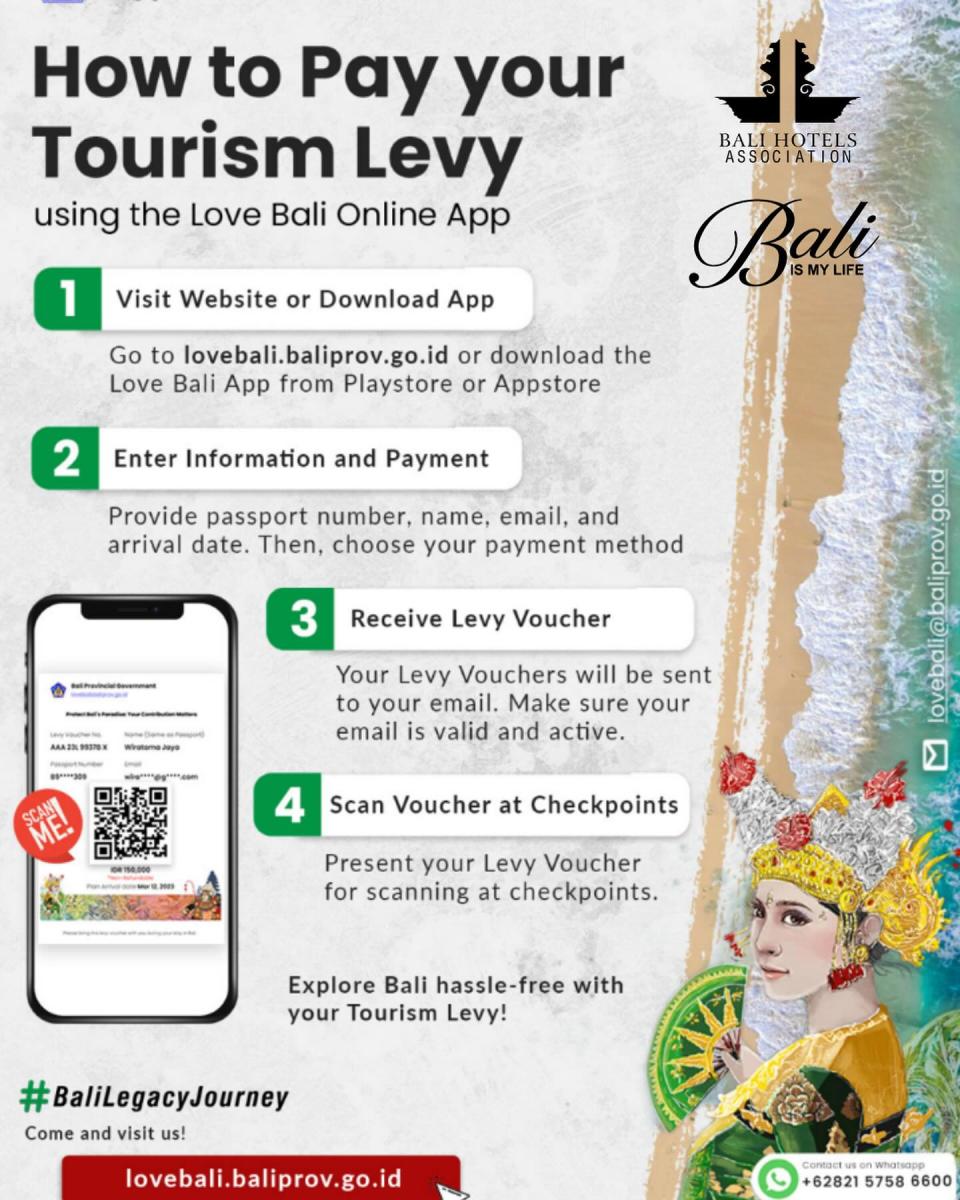

Commencing February 14, 2024, international visitors to Bali will be subject to a one-time fee of IDR150,000 (USD 10). Please note the one-time payment is per each visit/arrival into Bali and applies to adults and children of all ages. International visitors are encouraged to conveniently settle this payment via the Love Bali website or App prior to their arrival. Upon payment, a tourism levy voucher will be sent via email, and the QR code can be downloaded to smartphones, or printed for scanning at checkpoints in Bali Airport and sea ports.

There will also be Bank counters available at the Bali International Aiport, for those that are unable to pay online before arrival. Cashless transactions only.

The following visa categories automatically receive exemption from the foreign tourism levy without needing to apply: A. diplomatic and official visa holders, B. conveyance crew, C. KITAS and KITAP holders, D.family unification visas,

and E.student visa holders.

F.Golden Visa Holders and G. holders of other visa types are only exempt from payment after applying for receiving approval on the official Love Bali website/app.